Understanding Forex Trading Regulations: A Comprehensive Guide

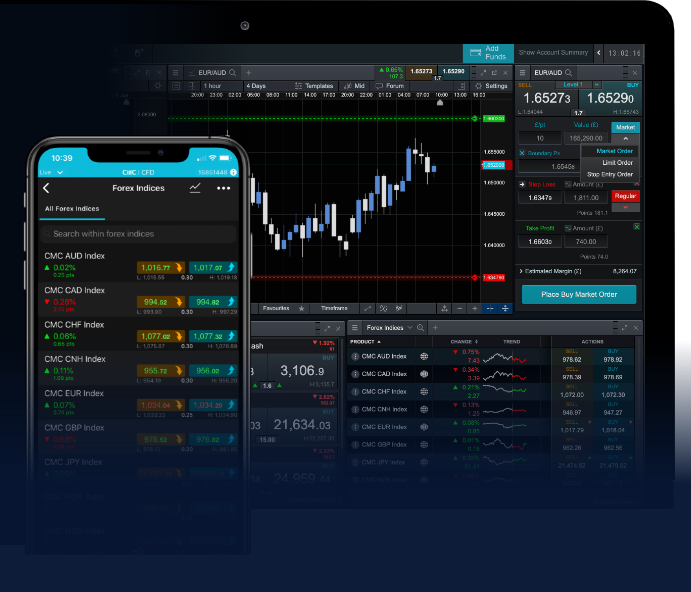

The world of Forex trading is vast and complex, requiring a deep understanding of various regulations that govern the market. As a trader, ensuring compliance with these regulations is essential for protecting your investments and maintaining the integrity of your trading activities. In this article, we will delve into the core aspects of Forex trading regulations, explore their significance, and provide insights into how they affect traders. For those looking to enhance their trading experience, various forex trading regulations Forex Trading Apps can assist in navigating this landscape.

What Are Forex Trading Regulations?

Forex trading regulations are legal frameworks set by governmental and financial authorities to oversee activities in the foreign exchange market. These regulations aim to protect traders, ensure fair practices, and promote a transparent trading environment. Forex regulated firms typically adhere to strict compliance measures that safeguard against fraud, manipulation, and insolvency.

Importance of Forex Trading Regulations

Understanding Forex trading regulations is crucial for several reasons:

- Protection of Traders: Regulations are designed to protect traders from scams and unethical practices. By trading with regulated brokers, traders can ensure their funds are safe and secure.

- Market Integrity: Regulations help maintain the integrity of the Forex market by enforcing rules that prevent market manipulation and unfair practices.

- Dispute Resolution: Regulated brokers often have mechanisms in place for resolving disputes, offering traders a recourse if issues arise.

- Investor Confidence: Adherence to regulations increases investor confidence in the marketplace, promoting overall engagement in Forex trading.

Key Regulatory Bodies in Forex Trading

Different countries have established regulatory bodies responsible for the oversight of Forex trading. Here are some of the most prominent authorities:

- U.S. Commodity Futures Trading Commission (CFTC): The CFTC is responsible for regulating commodity futures and options markets in the United States. It works to protect market participants and the public from fraud, manipulation, and abusive practices.

- National Futures Association (NFA): The NFA is a self-regulatory organization in the U.S. that oversees forex brokers. It requires members to meet specific financial standards and adhere to a code of ethics.

- Financial Conduct Authority (FCA): The FCA regulates financial firms in the UK, ensuring they operate honestly and transparently. It provides strong protection for retail Forex traders.

- Australian Securities and Investments Commission (ASIC): ASIC regulates financial services and markets in Australia, enforcing compliance with laws and ensuring the integrity of the Forex market.

- European Securities and Markets Authority (ESMA): ESMA oversees the securities markets in the European Union, including Forex trading, implementing regulations that enhance investor protection.

Types of Forex Regulations

Forex regulations can be divided into several categories, each addressing different aspects of trading:

- Licensing: Forex brokers must obtain licenses from regulatory bodies to offer their services legally. This process often involves rigorous vetting to ensure the broker meets specific financial and operational standards.

- Leverage Limits: Some regulatory bodies impose limits on the amount of leverage brokers can offer. This measure aims to protect traders from excessive risk, as higher leverage can magnify both gains and losses.

- Segregation of Funds: Regulations often require brokers to keep client funds separate from their own operational funds. This segregation helps ensure that traders’ money is protected in the event of the broker’s insolvency.

- Reporting Requirements: Brokers may be obligated to provide regular reports on their financial status, ensuring transparency and accountability in their operations.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies: Regulators require brokers to implement AML and KYC policies to prevent illicit activities. These policies involve verifying the identity of clients and monitoring transactions for suspicious activity.

The Impact of Regulations on Trading Strategies

Forex trading regulations can significantly influence trading strategies. Here are some ways in which they affect traders:

- Adjusting Leverage: Traders need to be aware of leverage limits imposed by regulators, which can alter their trading strategy and risk management approach.

- Choosing Brokers: Awareness of regulatory status affects broker selection. Traders tend to prefer brokers regulated by reputable authorities to enhance trust and security.

- Compliance Awareness: Traders must understand and comply with relevant regulations, including position limits and reporting requirements, to avoid potential repercussions.

- Adaptation to Market Changes: Traders need to stay informed about changing regulations as they can affect market dynamics and trading behavior.

Challenges and Criticisms of Forex Regulations

While Forex regulations provide many benefits, they are not without challenges and criticisms:

- Compliance Costs: Regulations can lead to increased operational costs for brokers, which may be passed on to traders through higher fees or spreads.

- Reduced Access: Stricter regulations can limit access to leveraged trading for some retail traders, potentially reducing their trading opportunities.

- Inconsistency Across Jurisdictions: The lack of uniform regulations across countries can create confusion for international traders and make it challenging to navigate compliance.

Conclusion

In conclusion, understanding Forex trading regulations is essential for any trader looking to navigate the dynamic world of foreign exchange effectively. By familiarizing oneself with the various regulatory frameworks, the importance of compliance, and the roles of different authorities, traders can protect their investments and contribute to a healthier trading environment. Whether you’re a novice or an experienced trader, staying informed about the ever-evolving landscape of Forex regulations is crucial for long-term success in the market.